When you look at your credit card statement, you will likely see the term “APR” (Annual Percentage Rate) followed by a percentage. Many people assume this is just another name for the interest rate, but there is a subtle and important difference between the two.

Understanding the difference between APR and interest rate is essential for managing your debt and avoiding unexpected charges. This article explains what these terms mean, how they affect your monthly bill, and what you can check on your own statement.

The Interest Rate is the specific cost of borrowing the principal amount of your debt. The APR is a broader measure that includes the interest rate plus any additional fees or costs associated with the card. For most credit cards, the APR and the interest rate are often the same number, unlike mortgages or car loans.

What is an Interest Rate?

In simple terms, the interest rate is the percentage of the principal (the amount you spent) that the bank charges you for borrowing money.

- How it works: If you carry a balance from month to month, the bank applies this rate to your “average daily balance.”

- Why it matters: It is the primary factor that determines how much “interest charge” you see on your monthly statement.

What is APR (Annual Percentage Rate)?

APR is designed to give you a more complete picture of the total cost of credit over a year.

- The Formula: It includes the interest rate plus any mandatory fees (such as annual fees or origination fees).

- The Comparison: Because APR includes fees, it allows you to compare two different cards fairly. For example, a card with a 15% interest rate but a $100 annual fee might have a higher APR than a card with a 16% interest rate and no annual fee.

Comparison: APR vs. Interest Rate

| Feature | Interest Rate | APR (Annual Percentage Rate) |

| What it measures | The cost of the balance only. | The total cost of credit (Interest + Fees). |

| Transparency | Narrow view. | Broad, “all-in” view. |

| Legal Requirement | Not always required in ads. | Must be disclosed by law (Truth in Lending Act). |

| Use Case | Calculating monthly interest. | Comparing different card offers. |

Why This Matters for Credit Card Users

In many cases, credit card issuers do not charge “origination fees” like mortgage lenders do. Therefore, you may notice that your Interest Rate and your APR are identical.

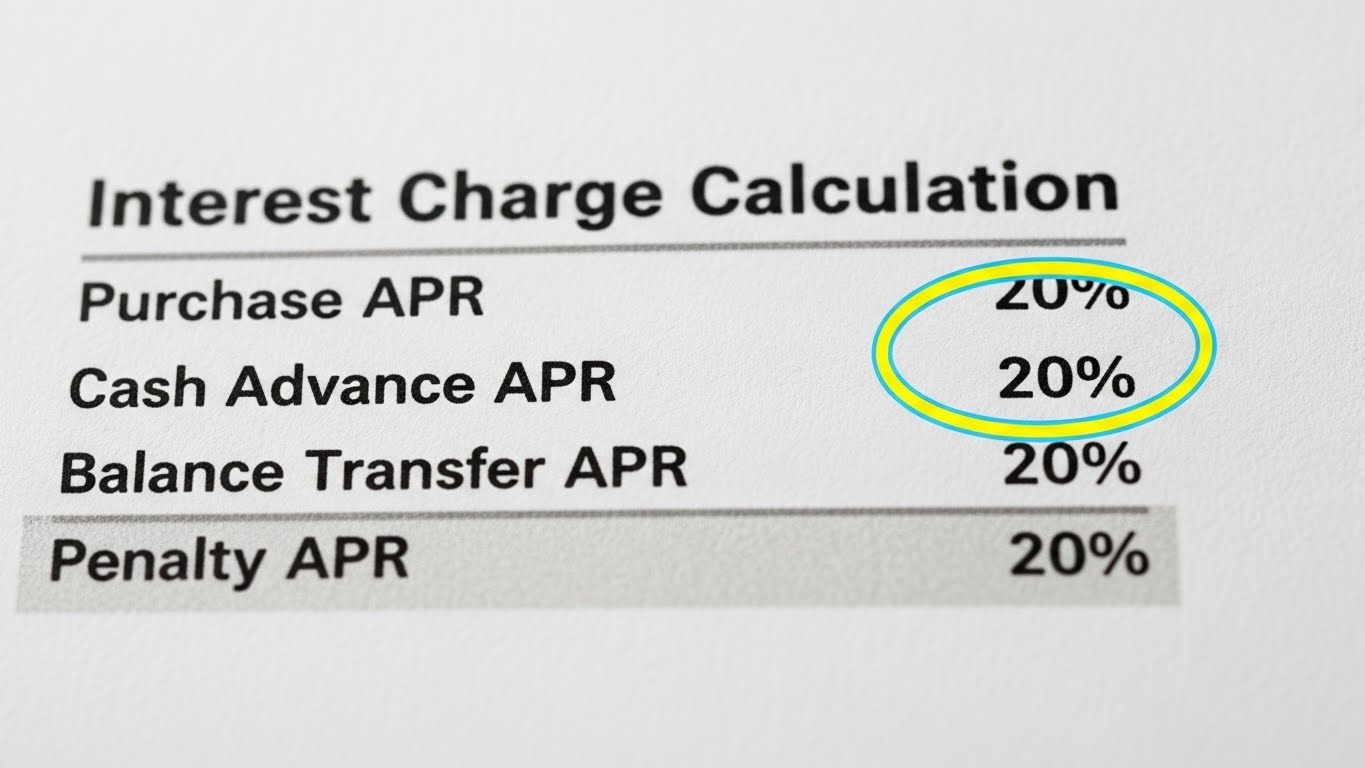

However, you should be aware of different types of APR on a single card:

- Purchase APR: The rate applied to standard shopping.

- Cash Advance APR: A much higher rate (often 25%+) for taking cash from an ATM.

- Penalty APR: An increased rate that triggers if you miss a payment.

What Users Can Check Themselves

If you feel your interest charges are too high, you can review these details on your statement:

- The “Interest Charge Calculation” Section: Usually found on the back or the last page of your statement. It breaks down which APR was applied to which balance.

- Variable Rate Disclosures: Most credit cards have a “Variable APR,” meaning your rate can change if the Federal Reserve raises interest rates.

- Introductory Periods: Check if you are still in a “0% Intro APR” period and when exactly it expires.

⚠️ FixMyCard Tip: Even a “Low Interest” card can become expensive if you only pay the minimum. The best way to avoid interest entirely is to pay the statement balance in full every month.

Frequently Asked Questions (FAQs)

Is APR the same as the daily interest rate?

No. To find your daily rate, you must divide your APR by 365. For example, a 24% APR is approximately a 0.065% daily interest rate.

Why is my APR higher than the interest rate I was promised?

This usually happens if the card has an annual fee or if you are looking at the “Penalty APR” after a late payment.

Can I lower my APR?

In many cases, yes. If your credit score has improved or you have been a loyal customer, you can call your bank and ask for a “rate reduction.”

Does a 0% APR mean no fees?

Not necessarily. A 0% APR means no interest is charged on the balance, but you may still have to pay annual fees or late fees if you miss a deadline.

When to Contact the Bank

You should contact your card issuer if:

- You see an interest charge on your statement despite paying in full.

- Your APR increased suddenly without a clear reason.

- You want to confirm when a promotional 0% APR period ends.

Conclusion

While APR and Interest Rate are often used interchangeably in the credit card world, knowing that APR represents the “total cost” helps you make better financial choices. By monitoring your statement and understanding how your daily balance is calculated, you can better manage your payments and keep the cost of borrowing as low as possible.

Disclaimer:

This article is for informational purposes only. FixMyCard.com is not a bank or financial institution. For account-specific issues, please contact your bank or card issuer directly.

Recommended Reading

If you found this guide helpful, you might also want to check out these related finance tips and card-fixing tips:

- Why Did My Credit Score Drop After Paying My Balance?

- Is Paying Rent With a Credit Card Worth the Fees?

Sources: